Not known Facts About Paul B Insurance Medicare Advantage Plans Huntington

Check out the Medicare Parts A & B Earnings Related Modification Amounts page for details regarding earnings restrictions. If an individual did not sign up in premium Component A when first eligible, they might have to pay a higher regular monthly costs if they determine to sign up later (paul b insurance insurance agent for medicare huntington). The regular monthly premium for Part A may boost as much as 10%.

For people enrolling using the SEP for the Operating Aged and Working Handicapped, the premium Part A LEP is calculated by including the months that have actually elapsed between the close of the individual's IEP and also completion of the month in which the private enrolls. For enrollments after your IEP has actually finished, months where you had team health and wellness strategy protection are omitted from the LEP estimation.

If an individual did not enroll in Component B when first qualified, the individual might need to pay a late enrollment fine for as lengthy as the individual has Medicare - paul b insurance Medicare Part D huntington. The individual's month-to-month premium for Component B might go up 10% for each and every full 12-month period that the individual could have had Component B but did not authorize up for it.

Paul B Insurance Local Medicare Agent Huntington Fundamentals Explained

For enrollments after your IEP has finished, months where you had team health insurance protection are omitted from the LEP estimation. For individuals signing up making use of a Phenomenal Problems SEP, the International Volunteers SEP, or the SEP for Certain TRICARE Beneficiaries, no LEP will certainly be used.

A (Lock, A locked padlock) or means you've safely connected to the. gov site. Share delicate information only on official, safe and secure sites.

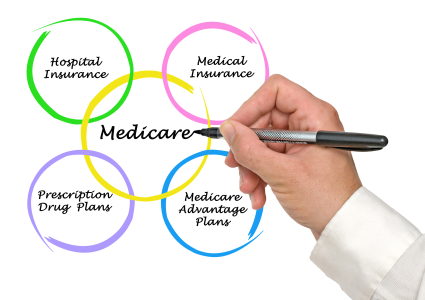

Medicare is separated right into four components: Learn just how the various parts of Medicare collaborate to assist cover your wellness treatment costs. To be qualified for Medicare, you need to go to the very least one: Age 65 or older Under 65 with certain specials needs Under 65 with End-stage kidney condition (permanent kidney failure calling for dialysis or a kidney transplant) or ALS (Lou Gehrig's disease) There are several methods to sign up in Medicare: If you make an application for Social Safety prior to transforming 65, you will be signed up immediately in Medicare Part An and Part B.

To use in individual or by phone, locate as well as call your regional Social Safety office. Several types of healthcare carriers approve Medicare. This includes physicians, healthcare facilities, taking care of houses, as well as in-home care providers. Locate more tips and programs to aid you plan for retired life.

Not known Facts About Paul B Insurance Medicare Insurance Program Huntington

If you do not qualify by yourself or through your partner's job record yet are an U.S. resident or have actually been a legal citizen for at the very least five news years, you can get full Medicare advantages at age 65 or older. You just have to acquire into them by: Paying costs for Part A, the health center insurance coverage.

The longer you function, the more work credits you will make. Work credits are earned based upon your revenue; the amount of revenue it takes to gain a credit history modifications each year. In 202 3 you make one job credit score for every single $1,640 in incomes, approximately a maximum of 4 debts per year.

If you have 30 to 39 credit histories, you pay less $278 a month in 202 3. If you proceed functioning until you gain 40 credit histories, equitable life insurance you will no much longer pay these costs. Paying the same monthly costs for Component B, which covers doctor visits and various other outpatient services, as various other enrollees pay.

90 for individuals with an annual earnings of $97,000 or much less or those filing a joint tax obligation return with $194,000 in earnings or less. Rates are greater for individuals with greater incomes. Paying the same month-to-month premium for Component D prescription drug protection as others signed up in the medicine plan you pick.

Some Known Details About Paul B Insurance Medicare Insurance Program Huntington

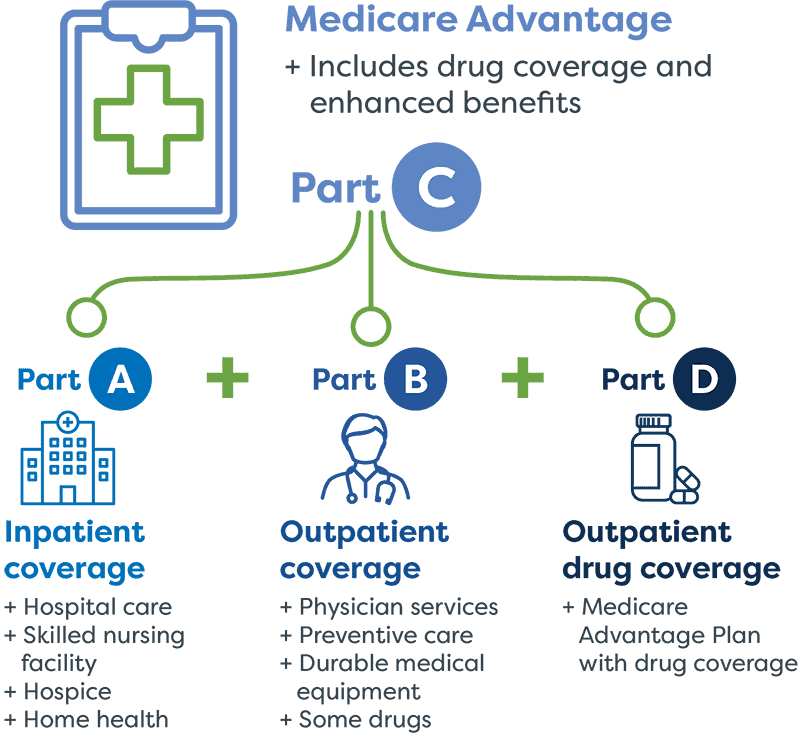

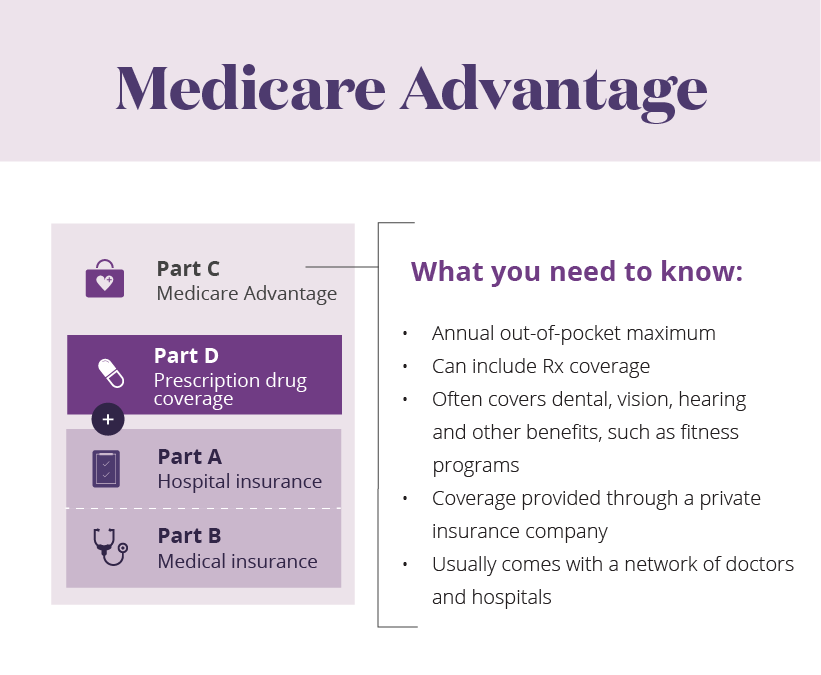

If you acquire Component A, you also should register in Part B. You can not sign up in a Medicare Benefit plan, which is a private insurance coverage option to Original Medicare, or get a Medigap supplemental insurance policy unless you're registered in both An and also B.

Generally, usually're first eligible very first sign up authorize Part A component Part B component 3 months before you prior to 65 and ending And also months after the month you turn 65. Because the firm has less than 20 employees, your job-based protection might not pay for health and wellness solutions if you don't have both Part An and also Component B.

Some Known Details About Paul B Insurance Medicare Agency Huntington

Your coverage will start the begin after Social Security (protection the Railroad Retirement Railway) gets your completed forms.

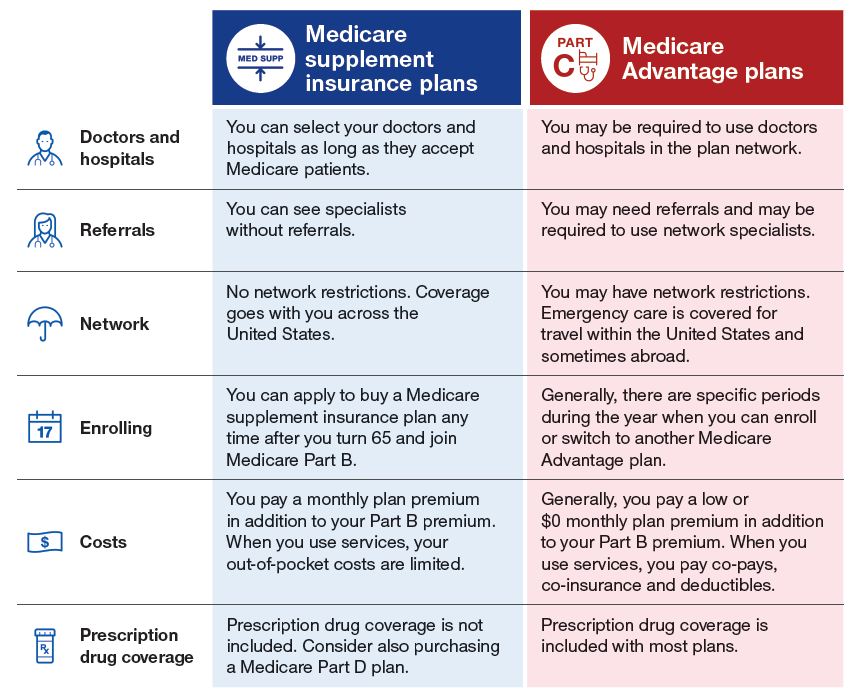

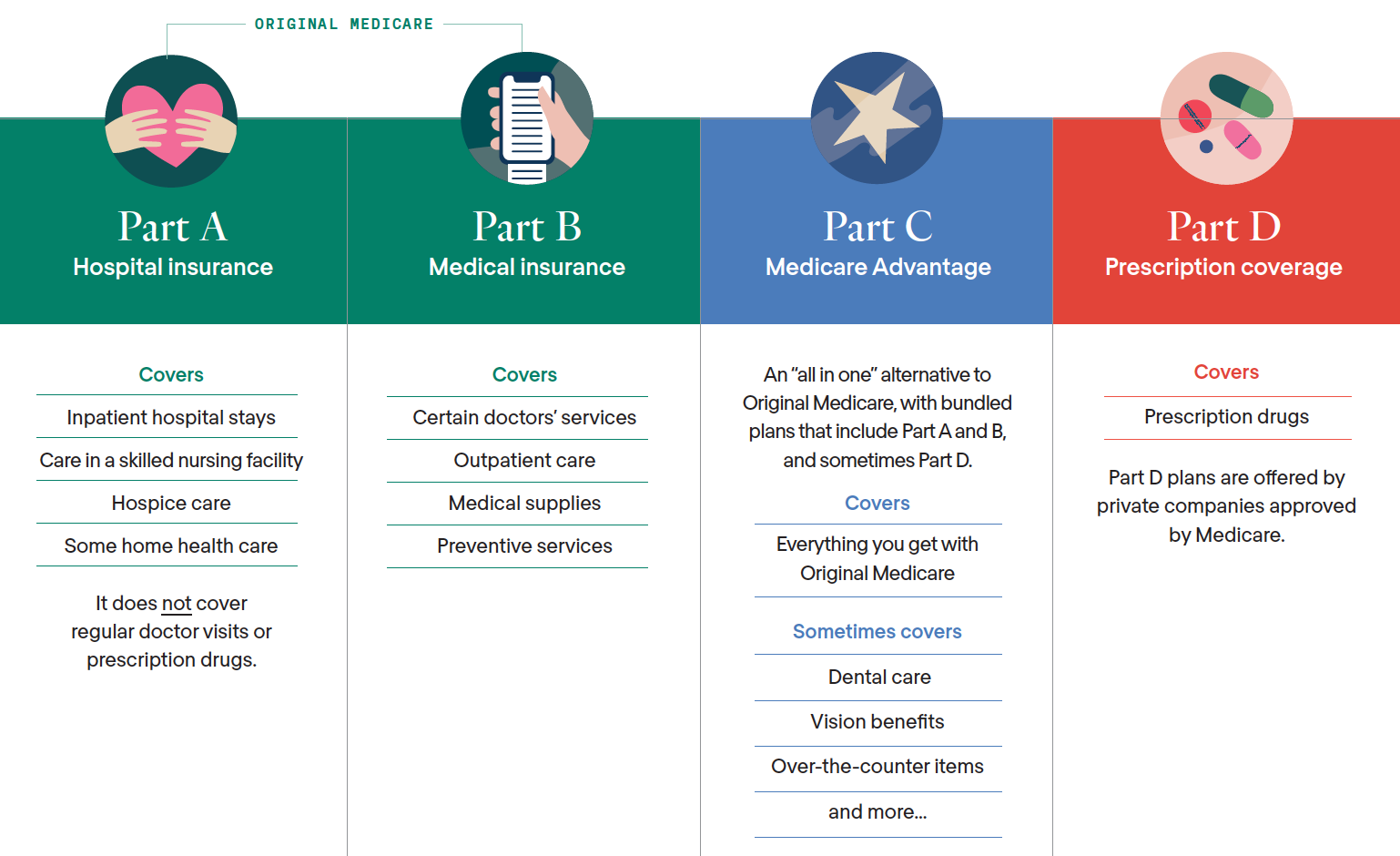

Relocating your wellness insurance coverage to Medicare can really feel overwhelming and also complicated but we can assist make it much easier. The primary step in choosing the ideal protection is comprehending the 4 components of Medicare. Below, discover the essentials of how each part functions and also what it covers, so you'll recognize what you require to do at every action of the Medicare procedure.

(People with particular disabilities or health conditions may be qualified before they turn 65.) It's made to shield the health and wellness as well as wellness of those who use it. have a peek at this website The 4 parts of Medicare With Medicare, it is essential to recognize Components A, B, C, and also D each part covers details services, from treatment to prescription medications.

.png)